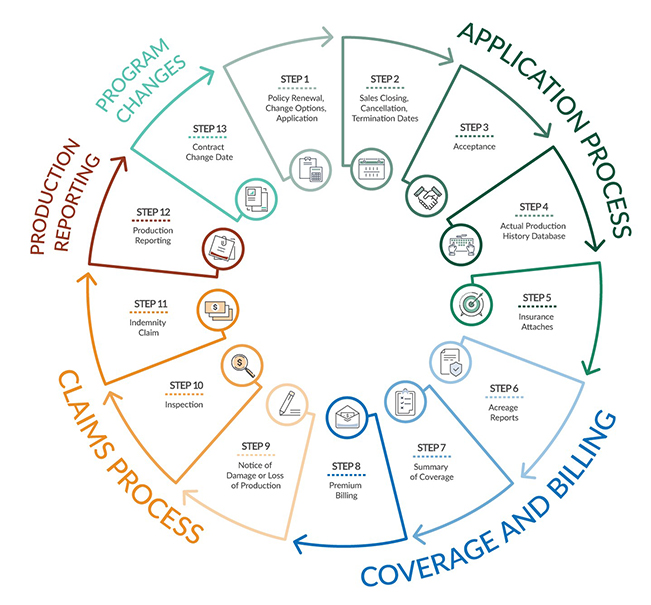

Application Process

Step 1: Policy Renewal, Change Options, Application

The insurance cycle begins each year with the insurance offer. The Risk Management Agency (RMA) annually publishes actuarial documents which list plans of insurance, crops or commodities, types, varieties, and practices that may be insured in a state and county, and shows the amounts of insurance, available insurance options, levels of coverage, price elections, applicable premium rates, and subsidy amounts. The Special Provisions within the actuarial documents, list program calendar dates and general and special statements which may further define, limit, or modify coverage. Producers have several months between the initial insurance offer and the sales closing date, giving them an opportunity to work with an agent to review available offers and develop a risk management strategy for their operation.

Step 2: Sales Closing, Cancellation, Termination Dates

Insurance applications must be completed and signed no later than the sales closing date specified in the Special Provisions. Applications signed after the crop’s sales closing date will not be accepted by the insurance provider.

Insurance coverage is continuous and can be canceled by the policyholder for the following crop year by providing written notice to their insurance provider no later than the cancellation date specified in the Special Provisions. For a policyholder insured the previous crop year, any changes they make to policy coverage must be made on or before the crop’s sales closing date. The policy will automatically renew for the subsequent crop year unless the policyholder cancels the policy in writing on or before the crop cancellation date.

Insurance coverage may be terminated by the insurance provider for the following crop year for nonpayment of outstanding debt by providing written notice to the policyholder at least 30-days before the termination date specified in the Special Provisions. The insurance provider may cancel coverage on a crop if no premium is earned for three consecutive years.

Step 3: Acceptance

Upon receipt of a properly completed and timely submitted insurance application, the insurance provider will accept and process the application, unless the applicant is determined to be ineligible under the contract or federal statute or regulation. The insurance provider will provide the appropriate policy documents to the applicant. After the application is accepted, the policyholder may not cancel the policy for the initial crop year.

Step 4: Actual Production History (APH) Database (for APH-based Plans of Insurance)

The insurance provider uses the policyholder’s prior year’s production report to populate their APH database(s) and calculate the approved yield(s). The APH database must contain a minimum of four crop year yields and a maximum of ten crop year yields. If the APH database has less than four years of actual yields, then transitional yields (T-Yields) are used to complete the APH database to meet the minimum of four crop year yields. If an approved yield cannot be established for any APH database for the current crop year using the prior year’s production report, the policyholder must provide a new production report containing the prior year’s production on the basis of the current crop year’s unit structure (by county/crop/practice/type/transitional yield map area (TMA), or other characteristics, if applicable).

Step 5: Insurance Attaches

Insurance attaches each crop year on the date specified in the Commodity Provisions.

For annual crops, insurance attaches each crop year when the crop is planted on the insured acreage for the unit. The crop must be planted on or before the crop's published final planting date unless late or prevented planting provisions apply. If prevented planting provisions apply, and the crop cannot be timely planted due to the causes specified in the Crop Provisions, such acreage may be eligible for a prevented planting payment.

For perennial crops and livestock commodities, insurance attaches each crop year on the calendar date specified in the Crop Provisions.

Coverage and Billing

Step 6: Acreage Reports

The policyholder must annually report for each insured crop in the county the number of insurable and uninsurable acres planted or prevented from being planted (if prevented planting coverage is available for the crop), the date the acreage was planted, share in the crop, the acreage location, farming practices used, and types or varieties planted, to the insurance provider on or before the applicable acreage reporting date. If the policyholder elected a contract price option, the contract is provided at this time. This report is used by the insurance provider to establish the amount of coverage and premium for the crop. Insurance providers may deny coverage if the acreage report is filed after the applicable crop acreage reporting date.

Step 7: Summary of Coverage

The insurance provider processes a properly completed and timely filed acreage report and issues to the policyholder a summary of coverage that specifies the insured crop, the insured acres, and amount of insurance or guarantee for each insurance unit. Under specific circumstances, the policyholder may make changes to the filed acreage report, if permitted by the insurance provider.

Step 8: Premium Billing

The annual premium is earned and payable at the time insurance coverage begins. The insurance provider will issue a premium billing based upon the information contained in the acreage report no earlier than the premium billing date specified in the Special Provisions. The premium billing will specify the amount of premium and any administrative fees that may be due. If the premium or administrative fees are not paid by the due date, the insurance provider may assess interest on the outstanding premium balance. Producers have several options for paying their premium, including the option to enter into a written payment agreement.

Claims Process

Step 9: Notice of Damage or Loss

In the event of damage or loss, the policyholder must file a notice of damage or loss for each unit within 72 hours of the policyholder's initial discovery of damage or loss of production, but not later than 15 days after the end of the insurance period unless otherwise stated in the individual crop policy. The policyholder should refer to the individual Crop Provisions for additional requirements in the event of damage or loss. These notifications provide the opportunity for the insurance provider to inspect the crop and determine the extent of damage or potential production before the crop is harvested or otherwise disposed of.

Step 10: Inspection

Once received, the insurance provider processes the notice of damage or loss and, if necessary, sends a loss adjuster to inspect the damaged crop and gather pertinent information. If the policyholder chooses to destroy or not harvest the crop, the loss adjuster will gather the appropriate information, conduct an appraisal to establish the crop’s remaining value, and complete any forms needed. If the crop has been harvested or will not be harvested by the end of the insurance period, and the policyholder chooses to file a claim for indemnity, the loss adjuster gathers the appropriate information and assists the policyholder in filing the claim for indemnity. It is the policyholder's responsibility to provide the insurance company all pertinent information for the loss adjuster to establish the time, location, cause of damage, and amount of any loss.

Step 11: Indemnity Claim

If the insurance provider determines an indemnity is due, they will issue an indemnity check and a summary of indemnity payment to the policyholder showing any deductions to the amount of indemnity for outstanding premium, interest, or administrative fees.

Production Reporting

Step 12: Insured’s Production Reporting Date

The policyholder must report their current year’s crop production on the same basis used to establish their approved yields (by county/crop/practice/TMA, or other characteristics, if applicable) by the insured’s production reporting date (some crops are excluded from current crop year production reporting; see the specific Crop Provisions and Special Provisions for excluded crops). This report is used by the insurance provider to populate the policyholder’s APH database and establish the approved yield the following crop year for APH-based plans of insurance.

Program Changes

Step 13: Contract Change Date

Throughout the year, RMA works with stakeholders to make sure that insurance products meet producers’ risk management needs. As a result, RMA may make changes to the insurance policy from one year to the next. Such changes will be available on the RMA website not later than the contract change date contained in the applicable Crop Provisions. The insurance provider will notify the policyholder in writing of any changes to the Basic Provisions, Crop Provisions, Commodity Exchange Price Provisions, if applicable, and Special Provisions not later than 30 days prior to the cancellation date for the insured crop. The policyholder will have the opportunity to review the changes and, if desired, continue the insurance coverage for the following crop year, change the policy coverage, or cancel the insurance coverage.