April 11, 2022

The 1996 U.S. Farm Bill was signed into law on April 4, which among other legislation created USDA’s Risk Management Agency (RMA) to oversee Federal crop insurance and other non-insurance-related risk management and education programs.

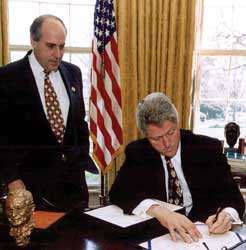

President Bill Clinton signs the U.S. Farm Bill into law with Dan Glickman, Secretary of Agriculture, in the Oval Office. April 4, 1996

As we just marked our agency’s 26th birthday this month, education programs are still an integral part of what we do. Currently, we are looking through proposals we received from organizations requesting RMA funding to deliver risk management education across the country. We will announce our newly funded projects in the coming months.

More than 1,600 producers are currently enrolled in such courses, and we anticipate many more will enroll this year. I’ve had the chance to talk with project managers from various university extensions, non-profits, and other organizations about the training they provide with this funding.

This week I spoke with Evan Lentz from Manchester, Connecticut, who is pursuing a master’s degree at the University of Connecticut. His focus is mostly on commercial fruit production. I got to hear about his experience learning risk management skills through courses RMA sponsored.

Marcia: Evan, thanks for taking time to talk to us. In addition to your studies, can you tell us about your background in agriculture?

Evan: I've done a lot of community outreach, testing, and produce multimedia content for Connecticut fruit growers and other stakeholders. I do have history in farming. My grandparents owned and operated a nursery, greenhouse, and farm in Middlefield, Connecticut called Perrotti's. My uncle has been a head grower at other large-scale greenhouses for his whole life. My aunt has worked with various work-therapy groups on local farms.

Marcia: Why did you choose risk management education courses?

Evan: My education goals are to finish with my master’s this summer. I hope to find a full-time position working for the University of Connecticut Extension and continuing my work. Risk Management was initially a work opportunity for me. I didn't know much at all to begin with. I worked for a couple years researching and producing Risk Management Newsletters for the RMA team that were delivered to various community stakeholders. I attended a number of various conferences and workshops related to agricultural risk management. Things kind of went from there.

Evan Lentz, Student, University of Connecticut

Marcia: What have you learned with your risk management education and training?

Evan: Risk management is a very vast subject. I've focused mostly on nutrient management, pest and disease control, and technology developed to help mitigate risks. An example of the latter is our drone study we have now. We are trying to develop a way to quickly identify nutrient and plant disease issues early and on a whole-farm scale. I've also dabbled in mental health and farming, which is an incredibly important risk to be managing.

Marcia: How has what you learned helped with your career and education goals?

Evan: Risk management helped to center a lot of the theoretical and practical information learned through my degree program. Things are often different in practice, and in practice risks are plentiful. Much of my career so far has been helping people prevent or mitigate risks associated with farming. Much of what I want to continue to do revolves around specific types of risk management and outreach. Many of the things farmers rely on with university extensions, like ours, is information about risks and support in preventing and mitigating risks. It's a rewarding endeavor when you know what you are doing is helping these farmers. Eventually I will have my own small farm and I will certainly be putting all of the risk management training I have learned to use.

Marcia: You mentioned owning a small farm as one of your goals. How important will risk management be in your plan, or any farm business plan?

Evan: I think a lot of farmers who have grown up farming are well-versed in its risks and risk management. I think people who are trying to get into farming or who pursue agricultural studies may have a bit less of an understanding of the constant risks until they are out there doing it themselves. There is certainly plenty of room to provide more education on specific risks, that maybe are not related specifically to production, say bookkeeping or other related business issues. Also, I mentioned mental health. I think the important thing is to make sure that farmers have access to resources such as extension events or crop insurance, as you mentioned. I've talked with all types of farmers, some are big time advocates for things like crop insurance, where some don't see how it fits into their business plan. But again, education and access to resources will allow them to choose for themselves. Oftentimes, risk management is folded in with other programming without mention of it specifically being risk management. I think education on what risk management is and all that it encompasses would be helpful and perhaps get people a bit more excited about it.

—

I thank Evan for sharing his experiences with us and we look forward to providing more risk management training opportunities for producers as we announce new projects soon.

Happy 26th birthday RMA, and here’s to many more!

– Marcia

Marcia Bunger is the Administrator of USDA’s Risk Management Agency (RMA). Prior to her appointment, she served as a County Executive Director for USDA’s Farm Service Agency. A native South Dakotan, Bunger is also the owner and operator of a 2000-acre farm, a cum laude graduate of Augustana College, and the first member of the Asian American and Pacific Islander community and first woman to serve as RMA Administrator.